What income is not counted for Snap?

The DTA looks at gross monthly income to decide if you are eligible for SNAP benefits and how much you will receive. But not all income counts. Here are examples of income that is not included in SNAP:

- People with the Child Tax Credit and the Earned Income Tax Credit are not included in SNAP. 106 C.M.R. §§ 363.130(E), 363.230(I), 363.140(G)(6).

- Federal and state tax refunds and other non-recurring lump sums of money such as insurance settlements or past benefits from other programs.

- Federal Emergency Management Administration (FEMA) financial assistance for COVID-19-related funeral expenses incurred after January 20, 2020.

- Vista, YouthBuild, AmeriCorps, and Foster Grandparent allowances, earnings, or payments for otherwise eligible individuals.

- Legally obligated child support payments that you make for a child who is living out of the home.

- Lump sum payments – such as inheritances, tax credits, injury awards, lump sum severance payments, or other lump sum payments.

- Universal Basic Income (UBI) pilot program payments funded (in whole or in part) by a private or non-profit organization. This currently includes: Family Health Project, Chelsea Eats, Cambridge Rise, United South End Settlements, and Rise Up Cambridge and the Pediatric Rise Programme.

- Reimbursement – Money received to pay you back for expenses, including training-related expenses and medical expenses. Payments received for certain DTA employment and training programs do not count as reimbursement payments.

- Anything you don't get in the form of cash – such as free lodging or food, or money that is paid directly to a landlord or utility company by a relative, friend, or agency that has no legal obligation to do so. Not there.

- The Senior Community Service Employment Program (SCSEP) pays a stipend to older workers who perform part-time community service work.

- A cash contribution given to you that provides a portion of your housing, food, or other needs, paid by a person or agency that has no legal obligation to do so.

- Veterans Services (M.G.L.C 115) Payment made directly to your landlord or utility company by vendor payment.

- Money earned by a child under the age of 18 attending high school or primary school, provided the child lives with a parent or other responsible adult.

- Up to $30 per household member over a three-month period that is not regular (such as money earned from odd jobs).

- Up to $300 from private donations over a three-month period.

- All financial aid to college students – federal, state and local and private. This includes grants, loans, scholarships, work-study, bursaries, and fellowships.

- Loans from private individuals and financial institutions, including loans against home equity (reverse mortgages).

- The first $130 per month in training stipend.

- Lump sum payments, such as tax refunds, state and federal Earned Income Tax Credit (EITC), insurance settlements, and past benefits from other programs.

- Combat pay earned by a service member while they are actively serving in a federally designated combat zone.

Verification of non-countable income

SNAP rules state that you do not need to verify non countableincome unless the information you provided is inconsistent or questionable.

FAQ's- What income is not counted for Snap?

Question: Are Child Tax Credit and Earned Income Tax Credits considered as income for SNAP?

Answer: No, these tax credits are not counted as income for SNAP.

Question: Do federal and state tax refunds count as income for SNAP?

Answer: No, tax refunds and other one-time lump sums like insurance settlements are not considered as income for SNAP.

Question: Is financial assistance from FEMA for COVID-19-related funeral expenses counted as income for SNAP?

Answer: No, FEMA financial assistance for COVID-19-related funeral expenses is not counted as income for SNAP.

Question: Are allowances from VISTA, Youthbuild, AmeriCorps, and Foster Grandparent programs considered as income for SNAP?

Answer: No, allowances, earnings, or payments from these programs are not counted as income for SNAP.

Question: Are legally obligated child support payments counted as income for SNAP?

Answer: No, child support payments for a child living outside the home are not counted as income for SNAP.

Question: Do lump sum payments, like inheritances or tax credits, count as income for SNAP?

Answer: No, lump sum payments such as inheritances, tax credits, or damage awards are not considered as income for SNAP.

Question: Are payments from UBI pilot programs, like Family Health Project or Rise Up Cambridge, considered as income for SNAP?

Answer: No, payments from UBI pilot programs funded by private or nonprofit organizations are not counted as income for SNAP.

Question: Are reimbursements for expenses, including training and medical expenses, considered as income for SNAP?

Answer: No, reimbursements for expenses are not counted as income for SNAP.

Question: Is non-cash assistance, like free housing or food, considered as income for SNAP?

Answer: No, non-cash assistance and payments made directly to landlords or utility companies by others are not counted as income for SNAP.

Question: Do stipends from SCSEP count as income for SNAP?

Answer: No, stipends paid to older workers through SCSEP are not considered as income for SNAP.

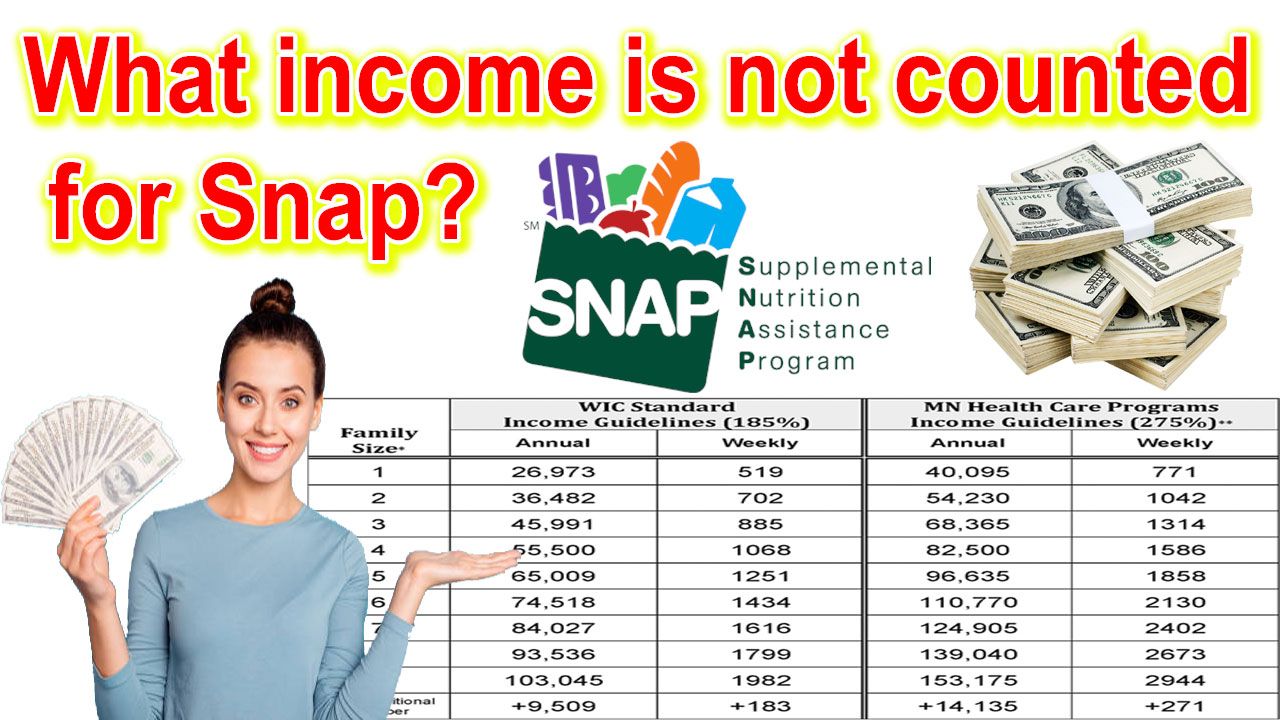

The Supplemental Nutrition Assistance Program (SNAP) is the largest federal nutrition assistance program. SNAP provides benefits to eligible low-income individuals and families via an Electronic Benefits Transfer card. This card can be used like a debit card to purchase eligible food in authorized retail food stores.